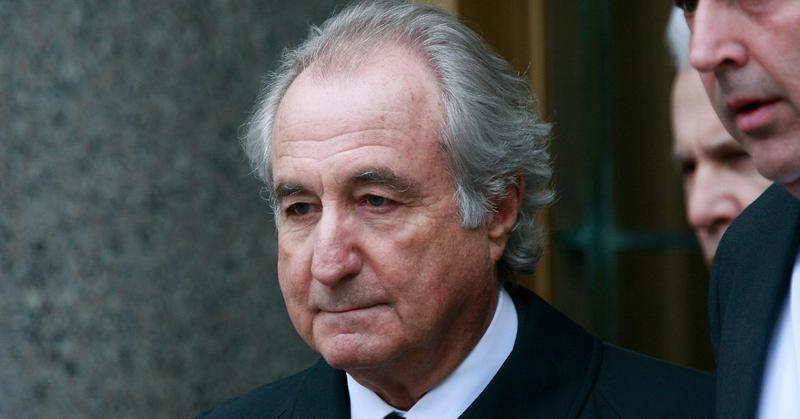

Bernie Madoff, The Biggest Scammer In History

By | February 17, 2022

For as long as there has been money, scammers and con artists have been swindling hardworking people for everything they've got, but Bernie Madoff stands out as the greatest fraudster of all, stealing an estimated $65 billion (yes, "billion" with a "B") using an old trick known as a Ponzi scheme, which basically boils down to pocketing money from initial investors and then reeling in more backers to repay the originals. This scheme can go on for some time, but as soon as the scammer fails to attract new clients or the investors decide to pull out, the whole thing falls apart. The scheme's namesake, Charles Ponzi, only managed to pull his scheme off for a year, costing his investors about $20 million, but Madoff kept it going for decades.

The son of struggling Polish immigrants, Madoff embarked on his financial career in 1960, when he used the money he saved from working as a lifeguard and a $50,000 loan from his father-in-law to open his own investment company. For a time, he was a legitimate and legitimately competent businessman. He began trading penny stocks, but over the next three decades, he gradually grew his company into a big-time investment firm, notable for dealing with celebrities and high-profile clients who spread the word of his financial wizardry.

In 1991, however, Madoff made the fateful decision to up his income by developing a highly obfuscated but, in the end, fairly simplistic Ponzi scheme. Strangely, the motivation for this choice is lost even on Madoff, who later reminisced, "I had more than enough money to support any of my lifestyle [sic] and my family's lifestyle. I didn't need to do this for that." Whatever the case, by his own admission, he began collecting money from investors that he never actually invested, and things snowballed from there.

The alarms began ringing in 1999, when financial analyst Harry Markopolos started to suspect that Madoff's windfall was too good to be true, and after only four minutes of crunching the numbers, he became convinced it was fraud. He turned his math over to the U.S. Security and Exchanges Commission, but they didn't seem very interested. Years later, Madoff joked about how close and amicable his relationship with the S.E.C. was during this era. "In fact, my niece even married [a member]," he said.

When the 2008 recession hit, many of his investors finally came knocking, and within months, the empire folded like a house of cards. By Thanksgiving, it was obvious that Madoff was hemorrhaging money. He told his family that his employees would be getting their Christmas bonuses early, and when his sons asked how he would manage that when he was having trouble paying back investors, he admitted that the whole operation was a Ponzi scheme and he was "done." He allowed his sons to turn him into authorities, as there was no escaping the reality of the situation. His investors are estimated to have collectively lost $65 billion dollars, with many losing their entire life savings.

Madoff's attorneys asked for a 12-year sentence because, according to insurance industry experts, he was only expected to live another 13, but the prosecutors were not overly concerned with the thief's golden years. They asked for a 150-year sentence, which was granted by the judge, who called Madoff's actions "exceedingly evil." Exactly two years after his arrest, Madoff's son, Mark, hanged himself, which haunted Madoff, who admitted in prison, "I destroyed our family." Those experts' predictions ended up being freakishly accurate: Bernie Madoff died on April 14, 2021, after serving 12 years in federal prison.